Obtain Quick Access to Economical Lending Providers for Your Monetary Needs

In the world of managing individual financial resources, the demand for quick accessibility to cost effective funding solutions typically develops unexpectedly. Whether it's for unanticipated expenses, financial investments, or various other financial commitments, having access to rapid and affordable financing options can supply much-needed alleviation. Nevertheless, browsing the landscape of car loan solutions can be complex and overwhelming. Understanding the different kinds of fundings available, the certification demands, and just how to compare interest prices and terms can make a substantial difference in your financial wellness. Remain tuned to uncover beneficial insights that can assist you make educated choices when it comes to securing the best funding for your details demands.

Benefits of Quick Access Car Loans

Quick accessibility lendings supply people with immediate financial support in times of immediate demand, providing a practical option to unanticipated expenditures. Traditional lending applications commonly involve lengthy approval processes, whereas fast accessibility lendings usually have minimal paperwork needs and quick approval times, occasionally within the very same day of application.

An additional benefit of fast accessibility lendings is their flexibility in terms of use. Borrowers can utilize these funds for a selection of functions, consisting of medical emergencies, automobile repair services, or unanticipated expenses. Unlike some typical loans that have restrictions on just how the obtained money can be spent, fast accessibility finances provide borrowers with the freedom to address their most important economic needs.

Additionally, quick accessibility financings can be a useful tool for individuals with less-than-perfect credit history. Several standard loan providers may refute funding applications based on credit rating, yet fast access loan carriers commonly consider various other elements such as revenue and work status, making them a lot more available to a bigger variety of consumers.

Sorts Of Budget Friendly Finance Services

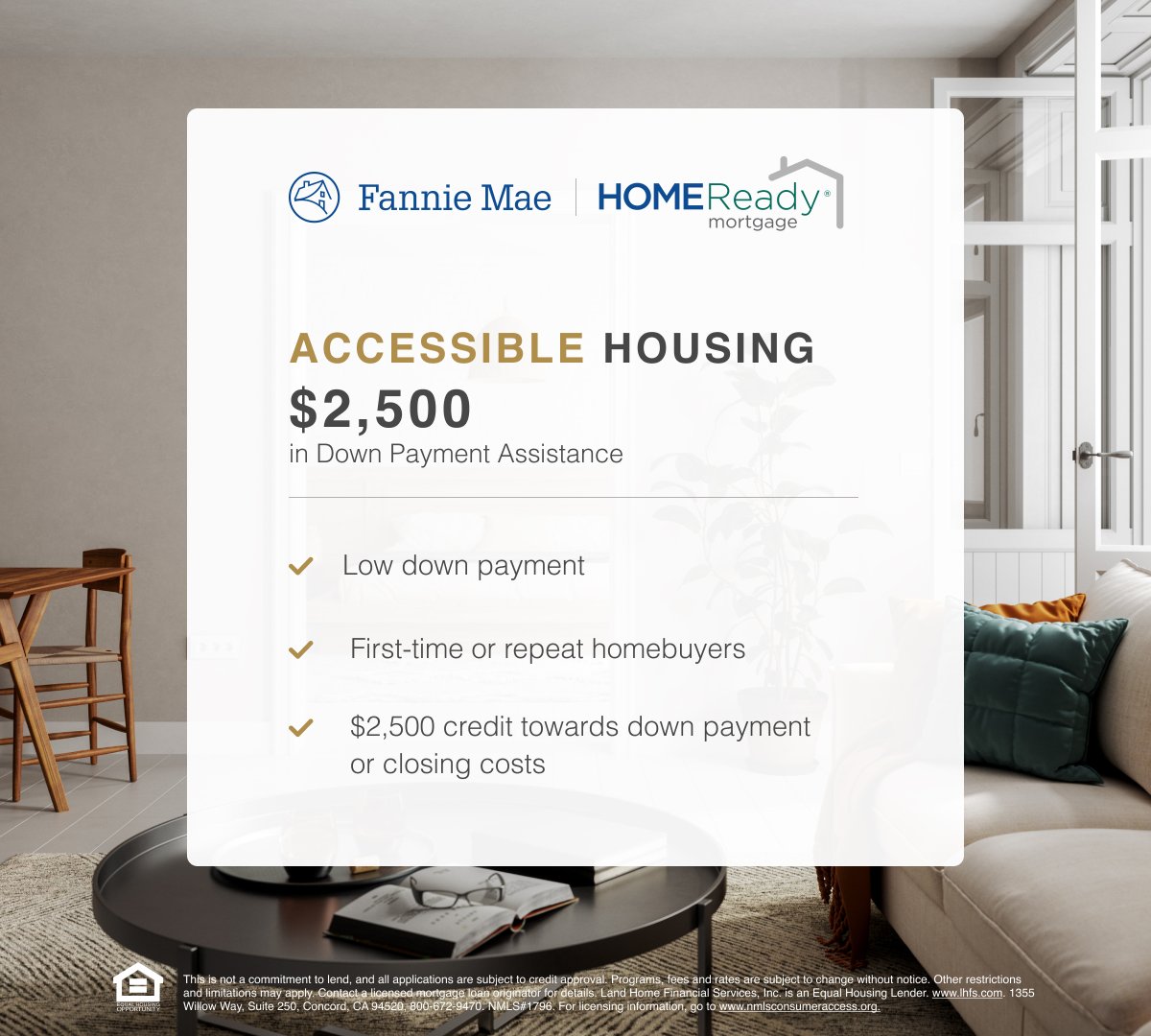

Amongst the array of monetary solutions offered, affordable finance services incorporate a range of alternatives tailored to satisfy the varied demands of customers. One typical kind is the individual car loan, which can be made use of for various functions such as financial debt consolidation, home renovations, or unforeseen costs. Individual car loans normally have actually fixed rate of interest rates and payment terms, making them a foreseeable alternative for borrowers. One more type is the cash advance, designed for people that require a small amount of money for a short period. Payday advance typically feature higher interest rates and fees as a result of their quick ease of access. In addition, installation finances give customers with a round figure that is paid back over a set period through repaired regular monthly repayments. This kind of financing appropriates for bigger expenditures that call for a longer settlement duration. Last but not least, safe finances call for security, such as a home or an automobile, to protect the funding amount, resulting in lower passion prices compared to unsecured loans.

Just How to Get Quick Financings

To be eligible for fast financings, individuals need to show a good credit history and a secure income history. Lenders providing quick financings prioritize these two elements to analyze the borrower's ability to pay back the finance quickly. A secure income shows that the consumer has a dependable source of funds to satisfy the finance commitments, lowering the threat for the lending institution. Similarly, a great credit rating mirrors the consumer's liable credit actions, making visit this page them a lower-risk candidate for the loan.

Contrasting Rate Of Interest Prices and Terms

When assessing loan choices, consumers ought to meticulously analyze the rates of interest and terms used by different lenders to make educated economic decisions. Rate of interest prices play an essential function in establishing the overall expense of loaning. Reduced rate of interest can lead to substantial financial savings over the life of the car loan, making it important to contrast rates from various loan providers. In addition, consumers should consider the terms of the funding, consisting of the settlement duration, costs, and any type of penalties for early payment.

Contrasting rates of interest and terms can assist customers choose a loan that straightens with their economic goals and capabilities. Some lenders may offer reduced rate of interest rates yet enforce stricter terms, while others might have a lot additional info more flexible settlement choices but greater rates. By evaluating these variables alongside, customers can select a financing that not just fulfills their immediate economic requirements but additionally fits within their long-term economic plans.

Tips for Repaying Loans on Time

Making certain timely payment of financings is critical for preserving economic health and wellness and preventing unneeded penalties or fees. Furthermore, developing a budget that includes your car loan settlements can aid you manage your finances better and designate funds especially for settlements.

Last but not least, checking your settlement progress frequently can aid you track your remaining equilibrium and remain encouraged to remove your financial obligation (easy loans ontario). By executing these suggestions, you can make sure that you settle your fundings on time and preserve your economic wellness

Verdict

Finally, quick access to affordable finance solutions can provide useful financial backing for people in need. By understanding the various sorts of loans readily available, certifying criteria, and contrasting rate of interest and terms, customers can make informed choices. It is very important to focus on timely repayments to prevent accumulating added charges and keeping a great credit rating. Overall, accessing fast fundings can offer a hassle-free remedy for managing economic needs successfully.

Traditional finance applications often involve extensive approval procedures, whereas quick gain access to finances typically have very little documentation requirements and quick authorization times, sometimes within the very same day here are the findings of application. Unlike some standard finances that have constraints on just how the obtained money can be spent, fast gain access to lendings supply debtors with the flexibility to resolve their most pressing monetary requirements.

Lenders offering quick financings focus on these two factors to assess the consumer's ability to repay the funding quickly. Providing accurate and current economic information during the finance application procedure can boost the chances of certifying for rapid car loans.